Retirement plans can be the biggest assets an individual owns outside of a home. During a divorce, the division of assets like these and others can be concerning. Illinois is an equitable division state, which means that marital property does not have to be divided evenly.

A handful of states require an even 50/50 split of assets upon divorce. These community property states include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. Assets acquired during marriage are considered equally owned by both spouses.

Illinois and the rest of the states are equitable distribution states. Despite the term, equitable distribution in terms of divorce does not mean dividing assets equally between divorcing couples. Rather, during divorce, several factors are considered during the division of assets.

Divorce courts, for instance, take into account the divorcing spouses’ assets and debts. Judges look at the needs of each individual, their contributions to the marriage and how long the union lasted. Future employability and earning power are factored in, as well as spending and savings habits.

What is considered marital property?

Any debts or property acquired during a marriage are considered marital property. Examples of marital property include real estate, cars, furniture, household appliances—and pensions and retirement plans. All of these marital assets are subject to equitable distribution in the state of Illinois.

Examples of retirement assets are many and varied. The diverse types of retirement plans include 401(k) (an employer-sponsored savings plan), 403(b) (a retirement plan offered by public schools), pension, IRA (an Individual Retirement Account) and TSP (a Thrift Savings Plan).

Retirement assets that are added during the course of the marriage are deemed marital property, despite most people believing the accounts should not be considered as such. However, as marital assets, retirement accounts lead to an increased balance of assets.

The greater balance of assets that results from deeming retirement accounts to be marital property can be explained. If only the husband worked and the wife maintained the home, only one retirement exists. While one spouse earned income, the other’s contributions to the home are not undervalued.

The entire retirement account is not divided during divorce. Rather, only the portion considered marital property is divided. This means that if one spouse paid into a retirement account during marriage, that portion of the account is marital property, regardless if only one spouse contributed the income.

Since retirement accounts are designed to increase in value over the course of years, it’s reasonable to question whether the future value should be considered in the divorce. A clear and immediate answer is impossible, forcing the courts to examine the many particulars surrounding divorce.

During some divorces, the courts may factor in the present value, while in other cases, it is far more beneficial to consider the future value. The taxation of money withdrawn from certain retirement accounts is a good reason to pay more attention to their future value.

What are the steps in the division of retirement assets?

Illinois courts decide how to divide the retirement assets based on what is equitable and fair to both parties. The first step is determining which retirement division order is necessary: Qualified Domestic Relations Order, Qualified Illinois Domestic Relations Order, or Military Retired Benefit Division Order.

As mentioned, a portion of the retirement account may not fall into the category of marital assets if it was added to the account prior to the marriage. Divorcing couples must prove the time frame funds were added to the retirement account by providing accurate records.

Once divorcing spouses determine how much a retirement account is marital property and its worth, it is easier to proceed. Upon divorce, one spouse may prefer to keep a car worth $10,000, rather than accept the marital portion of a retirement account worth an equal amount.

The Retirement Division Order that best pertains to the divorcing couple’s situation must be drafted. An attorney can be consulted to perform this task. Although some divorce lawyers do not draft orders, they may regularly work with professionals who specialize in drafting these documents.

Include the Retirement Division Order with the final divorce orders (which are simply how other assets will be handled). The spouse’s retirement plan administrator must approve the order. Ideally, the plan’s rules for division should be reviewed prior to drafting the retirement division order.

Once the court accepts the order, it can be submitted for execution. The time frame for execution is approximately one month after the divorce is finalized. Hiring a lawyer to handle the division of retirement assets during a divorce is beneficial, especially when divorcing couples are unable to agree.

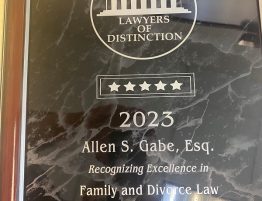

Allen Gabe Law, PC

Since the division of retirement assets can be complex, it helps to have an experienced divorce attorney from Allen Gabe Law, PC, on your side. Our skilled lawyers provide strong representation to individuals pursuing a divorce and help them resolve issues, including the division of pensions, investments, and retirement savings.

Divorcing couples need to provide financial records to show the courts what portion of the retirement accounts is marital property. Plus, the actual value of these assets must be determined. Both can be done with the services of an accountant, financial appraiser, or pension valuator.

Our law firm will connect you with reputable financial experts. We’ll build a case around your fair share of the retirement assets and fight for your rights in court. We’ve represented countless clients over the years and are experienced and knowledgeable about Illinois divorce laws.

As a family law firm, Allen Gabe Law, PC, specializes in divorce law. In addition to property division, we’ve successfully handled the many issues involved in the divorce process, such as tax implications, mediation, uncontested divorces, high asset divorces, and enforcing post decree judgments.

Qualified legal representation is a priority when you seek favorable outcomes during a divorce. Consult the divorce lawyers at Allen Gabe Law, PC, and receive the best legal counsel in Schaumburg, Illinois. Protect your assets by calling our office today and setting up a consultation with our lawyers.